Best Dividend Stocks to Buy & Hold in 2021

INTRODUCTION:-

So in this article we discuss which is the Best Dividend Stock to Buy in 2021 Which will be very profitable for you in this year..

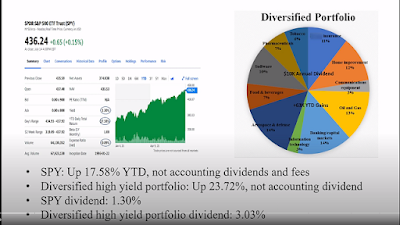

12 stocks in the 11 industries that i currently hold that are paying me more than

10 000$ in annual dividends on top of 63 000 year-to-date gains in the underlying

equities the pie chart that I've included provides a breakdown of the

overall portfolio based on investment percentage in the 11 industries as you can

see no more than 14 of the portfolio is invested in a particular industry so without

wasting more time let's get started...

#1 Aflec (life insurence company)

aflec that pays a 2.48 annual dividend is my first bid aflac has a track record of

raising dividends and has consistently increased its dividend payouts in february

each year since 2018. aflac is up15.25 year-to-date and this is anticipated as life

insurance companies are moderately inflationary resistant and generally do

well during moderate inflationary periods

#2 CISCO (communication equipment company)

cisco systems a communications equipment company that pays a 2.74 dividend is

my second pick cisco is up 23.04 years date and cisco has been consistently paying

dividends since 2011 and has increased its dividend payout several times from six

cents a share in 2011 to 37 cents a share today

#3 EXXONMOBIL (oil and gas company)

exxon mobil an oil and gas company that pays a 5.85 annual dividend is my third

pick exxon has been consistently paying quarterly dividends since 2013 and is

currently paying a dividend of 87 cents a share exxon to its credit has been getting

leaner and more efficient over these several years while maintaining its upstream

and downstream capabilities which at one point made exxon the most

valuable publicly traded company exxon is up 43.45 year-to-date and this is a

reflection of investors faith in exxon making the right business decisions to ride its

ship as exxon navigates the post covet oil and gas landscape without cutting its

dividend

#4 BANKING AND CAPITAL MARKET COMPANY

goldman sachs a banking and capital markets company that pays a 2.14 annual

dividend is my fourth pick goldman sachs has been consistently paying quarterly

dividends since at least 2013 and recently announced its decision to hike quarterly

dividends from a dollar 25 cents a share to two dollars a share goldman sachs

typically is not included in a high dividend yield portfolio but goldman sachs

numbers and metrics were just so amazing when i analyzed goldman sachs that i

had to include goldman sachs in my portfolio goldman sachs is up 41.48

year-to-date significantly outperforming market gains stocks that i would

consider if i'm more focused on higher dividend payout include city or a canadian bank

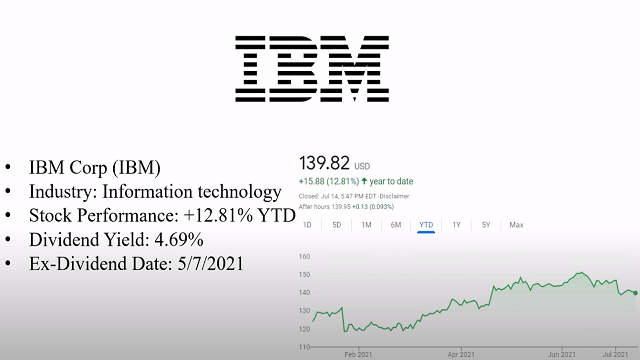

#5 IBM corp (Information and technology company)

IBM an information technology company that pays a 4.69 annual dividend if my

fifth pick and IBM has been consistently paying quarterly dividends since 2011 and

in may 2021 increased its quarter dividend payout to a dollar 64 cents per share

IBM is up 12.81 year-to-date IBM has been shedding much of its excess weight over

the last several years and the present-day IBM is a much leaner and more efficient

company with a clear focus on hybrid cloud and AI computing further IBM is one

of the few technology related companies that pays a dividend greater than three

percent thereby making IBM an attractive investment for dividend investors

looking to diversify into technology

#6 LOCKHEED MARTIN ( aerospace and defense company)

lockheed martin an aerospace and defense company that pays a two point seven six

percent annual dividend is my sixth pick lockheed currently pays a dividend of two

dollars and sixty cents per share and over the last three years a lockheed has hiked

dividends by 20 cents a share every year in november so if this pattern continues

lockheed's dividend should increase to two dollars and eighty cents per share in

november 2021. for the year lockheed is up 9.34 percent here today and in the

current geopolitical environment the defense and business will not slow down

anytime soon and will likely pick up due to ongoing geopolitical tensions and this

is evident by switzerland's recent 35 billion order of lockheed martin's f-35 fighter

jets

#7 LOWE'S ( home improvement company)

lowe's a home improvement company that pays a 1.66 percent annual dividend is my

seventh pick lowe's has consistently raised his quarterly dividends in july each year

since 2013. lowe's is up 20.18 years a day and the stock will likely continue its

uptrend due to high home improvement and home construction demands

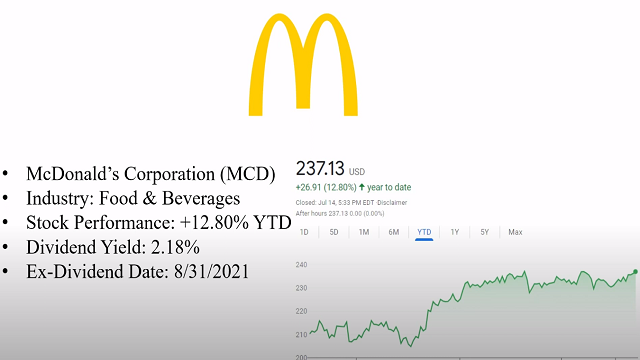

#8 Mc Donald's ( food and beverage company)

mcdonald's a food and beverages company that pays a 2.18 annual dividend is my

eighth pick mcdonald currently pays a dividend of a dollar and 29 cents per share

and over the last eight years mcdonald's has hiked dividends once a year in

november if this pattern continues mcdonald's dividend should increase again in

november 2021 for the year mcdonald's is up 12.8 percent as we exit the pandemic

indoor dining will pick up pace which would further increase mcdonald's top and

bottom lines which should thereby lead to better stock performance an alternative

to mcdonald's is coca-cola which has a higher dividend yield of 3.1 percent but is

only up 2.6 percent year-to-date or around 8.5 than mcdonald's

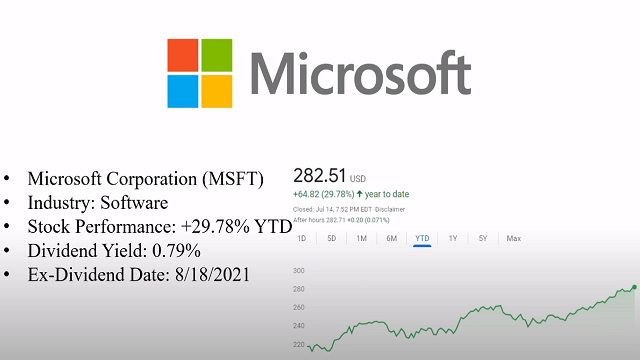

#9 MICROSOFT ( software company)

microsoft a software company that pays a annual dividend of 0.79 percent is my

night pick microsoft currently pays a dividend of 56 cents per share and over

the last 11 years microsoft has hiked dividends once a year in november so if this

pattern continues microsoft's dividend should increase again in november 2021.

dividend investors may scoff at microsoft's relatively low 0.79 dividend yield

however dividend investors need to account for microsoft's superior 29.78

year-to-date gains and a whopping 397 gains over the last five years which in my

opinion is a good compensation for the low dividend yield moreover any company

that gains almost 400 percent in five years it's not going to be able to keep up the

dividend yield simply due to the sheer amount of gains to the underlying equity

#10 Pfizer ( pharmaceuticals company)

pfizer a pharmaceutical company that pays a 3.9 percent annual dividend is my 10th

pick pfizer has been consistently raising its quarterly dividend payout amount in

november since at least 2014 so if this pattern holds pfizer will raise its dividend

payout again in november 2021. pfizer is up 8.53 here today however with a global

shortage of coveted vaccines and pfizer vaccine generally being considered as the

best vaccine available many countries are lining up to purchase pfizer vaccines

moreover in addition to manufacturing coveted vaccines pfizer products such as

preventive ibrance and eloquence each generate at least a four billion dollars of

revenue a year making pfizer a very profitable company

# 11 PHILIP MORRIS ( tobacco company)

phillip morris a tobacco manufacturing company that pays a 4.82 annual dividend

is my 11th pick philip morris's products such as marlboro are sold in over 180

countries and philip morris has been raising its dividend payout once a year

since 2013 and based on philip morris's payout pattern philip moore's current

quarterly dividend of a dollar and 20 cents a share is due to another hike in

september 2021. philip morris is up 22.16 percent year to date and philip

morris benefits from operating outside of the u.s where many tobacco laws are less

stringent than u.s laws and where tobacco products have less and

negative connotation and where a greater number of international population use

tobacco products

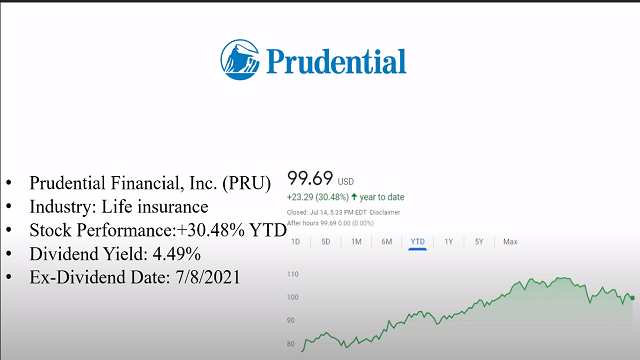

#12 PRUDENTIAL (life insurence company)

prudential another life insurance company that pays a 4.49 annual dividend is my

12th pick for the year prudential is up 30.48 almost doubling the s p 500

year-to-date returns this is again anticipated as life insurance companies

are moderately inflationary resistant and generally do well during moderate

inflationary periods

MY OPINION AND INVESTMENTS -:

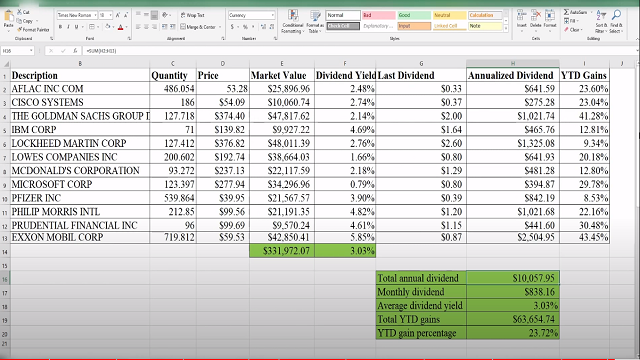

this spreadsheet provides another breakdown of my dividend portfolio as you can

see the underlying equities have gained sixty three thousand six hundred

and fifty four dollars year to date or a twenty three point seven two

percent year today

outperforming spy the most heavily invested s p 500 etf by 6.14 further the average

annual dividend yield of this portfolio is 3.03 more than double the

1.3 annual dividend yield of sby without incurring any management fees the

current annual dividend payout of this portfolio is ten thousand and fifty seven

dollars or eight hundred and thirty eight dollars per month further with dividend

reinvestment which i strongly recommend the dividends are reinvested into the

underlying stocks thereby adding to my holdings of the respective underlying

stocks which i agree do pay out higher dividend returns however dividends

from reits are taxed as ordinary dividends not qualified dividends which would

significantly add to my tax liabilities moreover it is my opinion that reits

generally underperform the market i rather form a portfolio that pays

me a little less in dividends but significantly outperforms the market

then get paid more in dividends but hold on to stocks that

underperformed the market let me know your dividend

investment strategies and which stocks you have in your

dividend portfolio

CONCLUSION

My conclusions are straightforward: investors should assess their stock market

holdings as they would any other business undertaking.

The firm paying out dividends is obviously generating incomes for an investor, however

even if the firm takes some investment opportunity then the incomes of the investors rise at a

later stage due to this profitable investment.

FAQ

- Can you make good money off dividends?

- which is the downside to dividend stock?

ans-: A few dangers to be aware of: In general, dividend-paying companies see less price

appreciation than growth stocks. Share prices can drop whether the stock pays dividends or

not. Companies can slash or eliminate their dividend payments at any time for any reason.

- How long do you have to hold the stock to get the dividend?

ans-: In order to receive the preferred 15% tax rate on dividends, you must hold the stock

for a minimum number of days. That minimum period is 61 days within the 121-day period

surrounding the ex-dividend date. The 121-day period begins 60 days before the

ex-dividend date.

- How do you know if a stock pays dividends?

ans-: Investors can determine which stocks pay dividends by researching financial news

sites, such as Investopedia's Markets Today page. Many stock brokerages offer their

customers screening tools that help them find information on dividend-paying stocks

- Why is dividend investing bad?

ans-:Taxes. The final problem with dividend investing is that it comes with hefty tax

consequences. Even if you're holding your dividend-paying investments longer than one

year (to get better tax treatment), you're still paying taxes every single year. This hurts your

investment returns.

SO, THAT'S IT FOR TODAY GUYS WE WILL MEET IN NEXT POST HAVE A GOOD DAY OR NIGHT

Post a Comment