Zomato IPO: Should You Place An Order To Buy Shares ..

- market status (zomato IPO)

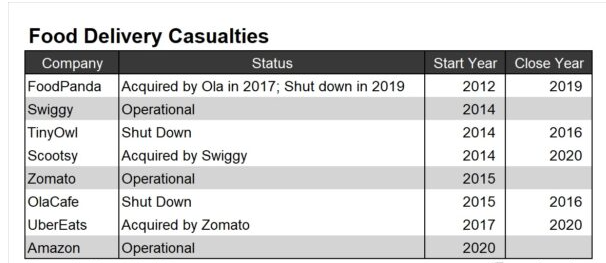

- Food casualty charts for demo

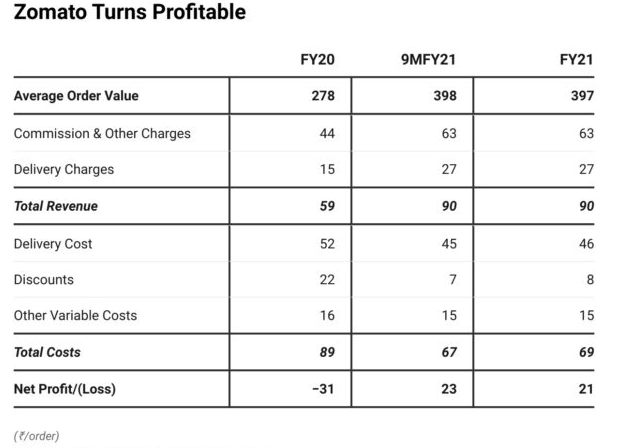

- Profits of investing in zomato IPO

- Demerits of investing in zomato IPO

- Zomato revenue model

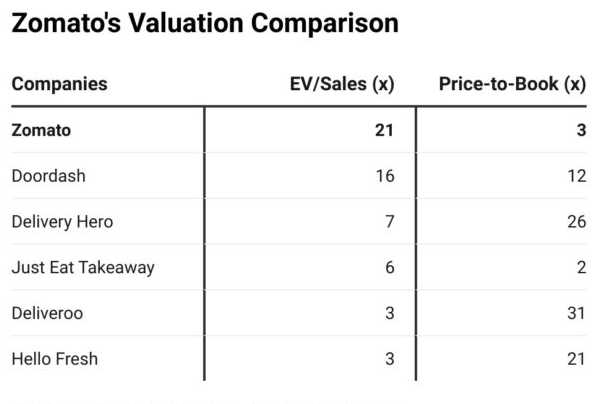

- Valuation chart

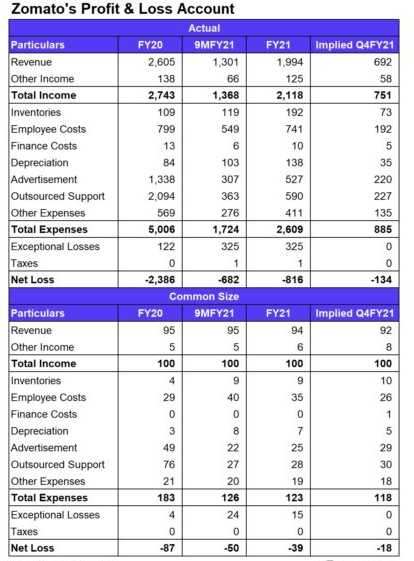

- Profit loss chart

- My personal opinion about investment

MARKET STATUS (zomato IPO)

important point that you should to note before buying zomato IPO

Two three important things the very first one about zomato IPO is something known as an anchor book

okay now

what is an anchor book?

there are certain investors who stand in the pool like an anchor you might have seen boats

are being anchored to the shore so similarly these investors stay anchored to the issue so

they are not allowed to sell right away post listing there is certain lock-in period for these

investors like tiger global Blackrock new world fund access mutual fund SBI mutual fund

HDFC mutual fund many key players who have invested in this IPO and it may be noted that

these funds raised through anchor investors are almost 45 percent of the total issue the

company has already 55.2 to crore equity shares to the anchor investors so

is that a goo build up for anchor book

answer is yes

second let's see what is the subscription status for zomato

it's clear that listing is

going to happen on both the NSE and BSE exchanges so this was a small clarification that

I wanted to give from the IPO size is huge it's huge it's 9375 crores worth IPO and still

it has gotten seven point six zero times over subscribe that's a big subscription for it all in all

if you can check retail categories five point six seven times in the retail category 11.63

in the qib and 1.07 times in the category so if you ask me is the subscription good enough

answer is yes if you ask me what about the financials they are not good right now

companies into losses I've told you so many times this is the third video that i'm doing on

the matter one was just understanding the business model second was understanding the

financials and this is the third one will i apply or not so is this a high-risk IPO answer is yes

company has been in continuous losses for those who believe that in the coming few years

the delivery business can do really well number one number two if they feel that

how they are portraying themselves as a technology company who is going to bridge the

gap between the restaurants and customers if you feel that this side of the business this line

in the business can do really well in the coming few months /years then i think it's worth

putting your money in this so i think it can be a long term story which you can look out for

zomato okay from the short term what may happen is there any space for listing games so

for that we always check this website IPO watch dot in which clearly mentions what is the

current gray market premium current gray market premium as on 16th of july what you can

see for zomato is 14 okay so the issue price is around 72 rupees 72 to 76 it's expected that

14 rupees premium can be seen on listing so it's almost a 15 to 20 percent gain but does it

happen that the moment your GMP is 40 rupees it means mandatory you will get a

premium of 14 rupees answer is no so there are chances though that it may list at a

premium what can be the downside let's understand markets are at an all-time high right

now there right now if it crosses 16000 then the next resistance level is at 16 200 but if it

is not able to cross 16000 we may see some sort of correction now on the listing day

if the market mode is not good enough on top of that companies and losses then could there be a problematic situation

answer is yes

so again i'm repeating those who are risk takers those who have the capacity to take the

risks can go ahead and apply for this IPO

food casualty charts

profits of investing in the zomato IPO

Now let us discuss the pros of investing in this IPO...

Zomato has covered nearly all aspects of the restaurant food chain, from procurement to

online delivery to advertisements and expected payment mechanism Zomato has shown 7x

growth from FY18 as compared to the industry growth of only 3.6x Now let us discuss the

network effect which is the benefit one gets when more and more people use it The more

people use Zomato, the more restaurants will be listed and will create a network

In fiscal 2021, Zomato's delivery partners fulfilled 94.1% of all orders with a median time

of 30 mins in FY21 The company has an efficient and high demand hyperlocal deliver

a network that can be monetized very well Zomato is a strong consumer brand recognized

all over India, People think of food as soon as they listen to Zomato

ZOMATO REVENUE MODEL

Zomato was a restaurant discovery platform that used to tell us everything like dishes, menu, location, etc

It is the largest food-focused restaurant listing, reviews, and online table reservation platform in India

It makes money through those restaurants that pay them to improve their visibility

As of Dec 2020, it had 3.5 lakh active listings on its platform.

Other than this, it has an exclusive paid membership named Zomato pro which provides flat discounts on selected restaurants and dine outs

Hence, Zomato makes money from this membership too and as of Dec 2020, it had 1.4 million such members.

Zomato has a subsidiary company called hyperpure which provides raw materials to restaurants

It not only helps them to forecast demand but to source raw materials such as grains, fruits, and vegetables on a larger scale

but is a part of the bundle services aligned with food delivery

This business was started in 2019 and as of Dec 2020, it has supplied raw materials in 6000 restaurants

in 6 cities And lastly, it makes money through food delivery. It acts as a delivery agent between

restaurants and customers They take a commission from restaurants and delivery charge from

customers They have operations in 23 countries other than India like UAE, Australia, New Zealand,

Philippines, Indonesia, Malaysia, USA, Lebanon, Turkey, Slovakia, and Poland

But the company's 90% revenue is generated from India only.

Traditionally, price-to-earnings is that the thanks to worth an organization. But, once it

involves firms like Zomato, one has got to shun the normal ways that of evaluating worth.

this can be as a result of an organization like Zomato continues to be within the part of

growing and burning money. profit might still be your time away.

Globally, food delivery firms area unit valued on revenue metrics as most of them area unit

loss-making even in mature markets. Zomato is priced at a premium to international peers

given the large growth potential within the Indian market. Even the last spherical of

funding was done at a premium to those international players. Compared to the last funding

spherical (February 2021), at the upper-end of the value band – ₹ seventy six – the

corporate is already posing for a premium of thirty first.

Zomato’s valuation for the most part hinges on the flexibility to sustain and fortify the leadership within the Indian market.

if we compare zomato's valuation chart

zomato profit and loss chart

MY OPINION ABOUT INVESTMENT ( ZOMATO IPO )

Am i a sticker yes i do have a risk taking capacity am i going to apply for this IPO yes

i have five Demat accounts out of five i'm going to apply through four Demat accounts so

i feel that i have the risk taking capacity i feel that i'm going to stay invested for a longer

term perspective maybe you want to do because even if i apply for from four i might get

one or two maybe depends on lottery system so i would be if i get the shares of this

company i would be holding it from a longer term perspective i would be checking out

quarter and quarter results and if i feel it's a promising one i may go ahead and hold it for a

comparatively longer time right so this is about the basic insights that i wanted to share

about the company am i going to apply answer is yes out of

five Demat accounts i'm going to apply through 4 Demat accounts

------------------------------------------------CONCLUSION-------------------------------------------

- price per share of zommato ipo

- ipo size and listing company

Great article with excellent idea!Thank you for such a valuable article. I really appreciate for this great information..

ReplyDeleterevenue model of zomato

I found your this post while searching for information about blog-related research ... It's a good post .. keep posting and updating information.

ReplyDeleterevenue model of zomato

Thanks for every other informative site. The place else may just I get that kind of information written in such an ideal means? I have a venture that I’m just now operating on, and I have been on the look out for such information.

ReplyDeleterevenue model of zomato

I’ve read some good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to create such a great informative website.

ReplyDeleterevenue model of zomato

Thanks for a wonderful share. Your article has proved your hard work and experience you have got in this field. Brilliant .i love it reading.

ReplyDeleterevenue model of zomato

I am unable to read articles online very often, but I’m glad I did today. This is very well written and your points are well-expressed. Please, don’t ever stop writing.

ReplyDeleterevenue model of zomato

Thanks for the post and great tips..even I also think that hard work is the most important aspect of getting success..

ReplyDeleterevenue model of zomato

I have read your blog it is very helpful for me. I want to say thanks to you. I have bookmark your site for future updates.

ReplyDeleterevenue model of zomato

This is highly informatics, crisp and clear. I think that everything has been described in systematic manner so that reader could get maximum information and learn many things.

ReplyDeleterevenue model of zomato

I admit, I have not been on this web page in a long time... however it was another joy to see It is such an important topic and ignored by so many, even professionals. professionals. I thank you to help making people more aware of possible issues.

ReplyDeleterevenue model of zomato

I am continually amazed by the amount of information available on this subject. What you presented was well researched and well worded in order to get your stand on this across to all your readers.

ReplyDeleterevenue model of zomato

Post a Comment