How to analyse an IPO

INTRODUCTION -:

In this article, we discussed How you can analyse an IPO the best top 10

parameters to analyse the IPO best for investment IPO, which we have

discussed in our blog twice before, whenever a company needs funds, it comes to

the market and takes its share. The share price of IPO sometimes gives a lot of

profit, in this session we will know how you can analyse the IPO of any

company easily. In this article, we will also tell you the top 10 such IPOs that you

must buy, if you want to know more details about

IPO, then the link is given below.

what is ipo & fpo, zomato ipo explained: should you invest in 2021

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>><<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

PREFACE

- DRHP & RHP

- BUSINESS MODEL / COMPANY ANALYSIS / PRODUCT ANALYSIS

- VALUATION / STRENGTH OF COMPANY

- RAW MATERIAL / MANUFACTURING

- SALES / FUTURE PLANS

- how can you do it

- ECONOMY ANALYSIS

- INDUSTRY ANALYSIS

- COMPANY ANALYSIS

- GMP

- RISK & LITIGATION

- HOW TO APPLY FOR IPO ?

- CONCLUSION

- FAQ

So without wasting more time let's get started so this is what we analyze

while analyzing the ipo of any company number one we first of all go and get the

most reliable document of the company which is either a drhp or a rhp first

drhp is filed by any company followed by which rhp is filed by the way

drhp is a draft red herring prospectus and rhp is a red

herring prospectus

i'm also going to tell you where can we find this drhp or rhp

@1

all is to be checked in that number one i try and understand the business model

of the company followed by we try to do an economy analysis then industry

analysis and then the company analysis that's what we call is as a top

to bottom approach for analyzing any company first economy then industry and

then company analysis followed by which after analyse after analyzing the

entire fundamentals of the company

@2

then we go ahead with checking the valuations of the company for valuations

we try to check out various valuations which are given in the

prospectus where to find them how to analyze them

@3

after that the last two things that which we check are number one is there any

litigation against the company so is there any court case which is going against

the company is it really serious or not is what we try and analyze and towards the

end what you check is the ipo details about the company

DRHP & RHP

now let's check out how to find the drhp or the rhp i'm going to discuss

three different possibilities possibility number one you can go directly to sebi

website and download these documents absolutely free of cost possibility number

two you can go to nse website and download this again free of cost or possibility

number three it's the chittorgadh website and the only difference between

first two websites and website is that first two websites are like somewhere related

to the government one is sebi which is the regulator second one is nse against

stock exchange chittorgarh is not anywhere related to the government

not an authorized one as such okay but still a very famous website for ipo these are

the three possible avenues through which you can get this document

how to download instructions-:

so how do you do that first you go to SEBI website you can just google it out and

that's how you land on the home page then you go to filings in filings drop down

and then you can see public issue in public issue you can go to draft offer for

drhp and for rhp there is red herring for rhp then what you do is you just select the

company and then you can download the file that's how it works for sebi website

now let me take you to nse website again even if you don't know the exact

web addresses as usual just type out on google so you can go to nse india on

google once you do that you have to go to products in products you will go

to initial public offering once you click that you can go to current market report

in that you go to book building then what you can do is select the company if you

want you can

scroll down and that's where you can find the rhp and then followed by

downloading the file well here goes the downloading button

for example i collected the data from abc name company

What did I do when I was about to invest in this company's IPO?

@1

BUSINESS MODEL / COMPANY ANALYSIS / PRODUCT ANALYSIS

so now whenever i were to do analysis or review of any ipo the first thing the first

question i ask is

what does the company do?

and if i want to know the exact business model of the company where do i find these

details right in the prospectus example the example of abc company when i

was analyzing the company while i was doing ipo review of that company what was

the first thing that came to my my mind what does the company do what are the

products so when i went through the section of our business i came to know that

company is more into specialty chemical in specialty chemical also they were more

into agro-related specialty chemical and they were saying that we make certain

products which are used as intermediates and other companies will use that as a

raw material to make fungicides pesticides whatever

@2

VALUATION / STRENGTH OF COMPANY

also second thing once i understand the product then what should i do i should see

if there are any specific strengths with the company do they have any long-term

contracts with big multinational companies or what that can be just one of the

strengths as an example

@3

RAW MATERIAL / MANUFACTURING

third thing i check what is the source of the raw material for their products

okay so just an

example -:

if raw material is coming from china and if there are certain trade disruptions can

that become a problem for the company yes so see from whom raw materials

are coming next i would want to check raw material again once raw materialism

then i check what is the manufacturing capacity of the company where are the

manufacturing capacities located how much percentage utilization they have done

so right now assuming they're only at 70 capacity utilization more and more they

go towards 100 that's where they'll actually witness economies of scale more and

more large scale production lesser and lesser will be the cost per unit

@4

SALES / FUTURE PLANS

next one is what exports or sales so if i do see that there are a lot of

exports that's also a positive sign if i see there are a lot of exports then i trust i try

to see how much is the revenue break up of exports is to domestic sales right but all

these things whatever i told about our business right now these are the current

scenarios so what is the last thing i try to check last thing is always what are their

future plans

if management has a very clean and clear thought process that okay this is what are

our future plans these are the strategies that we are going to implement and if you

feel these are very strong enough i think that's where comp is i mean that's where

your cycle of your basic business analysis ends

how can you do it

so let's start and understand

how to do economy analysis?

first of all we try and understand about the global economy then we try and

analyze our Indian economy position check out this website

" imf.org " that's there in front of you right now international monetary

fund website and what specifically if you want you can just go down and here you

can see a full report it's a pdf report free of cost you can read it what else do we

check we also check the

" world bank.org " website here also you get an access to a loads of information you

are going to get on this website itself so what we can do is that just scroll down and

here you can see something known as an essential reading inside essential reading

this is one very good read which is global economic prospects 2021

once we are done with just getting some information about global economy level

then we can go to indian economy level which is the website here you can check

is the dea.gov des department of economic affairs of the of our country here you

can just scroll down and you can see a monthly economic report every month data

will be published on how our economy as a whole is performing it has a lot of past

data as well you can just go through these reports

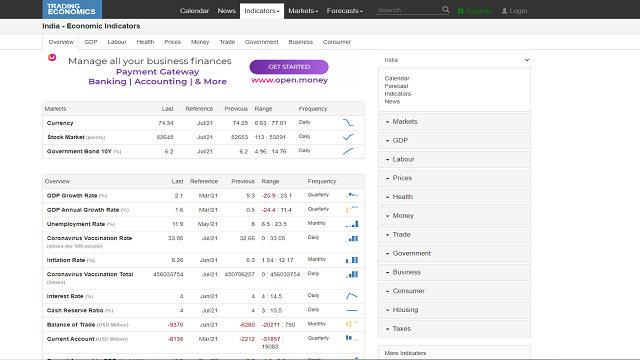

one more website which i check out not a government website it's a normal

website it's " tradingeconomics.com " select country india

and economic indicators in overview what specific points do i check i check the

gdp growth rate i check what is the gdp annual growth rate as well

okay in that we can also check unemployment rate other than these you

can also find a lot of other ratios like currently what is the crr what is the balance

of trade how much is the current account to gdp percentage okay all these are

various data points uh you whatever you can try and build your own conclusions

based on these it's a journey of understanding it just can't happen in

one single day slowly steadily you will get to know about all these things still after

going through so many data points if you are still hungry for knowledge then what

can you do

simple follow the steps

1) go to the prospectus

2) inside prospectus again you can see there is a separate section for economy

analysis right this for example a famous picture i might not have seen my own

dp so many number of times but i have seen this v-shaped recovery picture

much more times than my own dp right so this v-shaped recovery tells us about

the pre-coronavirus fall and post-corona virus recovery in our economy right that's

where you can get to know again about a lot of things and also certain special

points like what when i was doing the ipo review of abc company what we checked

was how india is performing in comparison with china india was growing at a

much faster rate as compared to china number one and number two even the labor

cost in india was much lower than china so these are few basic pointers that you

can check for economic analysis

INDUSTRY ANALYSIS

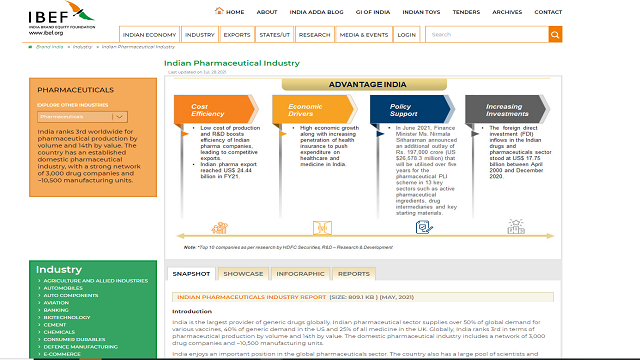

the very first thing that we can check is the website which is dot ibef.org it's

a good website in that the basic thing that you have to check is industry tab you get

an exposure to all these industries

so whatever industry you want to choose let us say i want to check the example

pharma company so i just can click on pharmaceuticals

once i click on pharmaceuticals i get to read anything and everything about the

entire pharma space that's how you can check one by one about various industries

once you're done with checking with these this website then you can additionally go

to the prospectus and inside the prospectus again you can see a lot of information

about the company whenever you are doing an industry analysis very important

is check the cagr which is the compounded annual growth rate and see whether

what is the current growth rate and what is the expected growth rate is expected

growth rate higher than the current growth rate

COMPANY ANALYSIS

i'm going to cover top five points that you have to check don't even look into

the notes first try and visualize if i were to do financial analysis of a specific

company number one i would check that p and l in p what am i going to check their

top line growth that is revenue growth okay second thing i'll check what is

the scenario at ebitda level earning before interest tax depreciation and

amortization ebitda 11 what is the what are the figures for ebitda as well as ebitda

margins also i will check right third thing what will i check is the bottom line and

bottom line

growth so basically profit after tax how much is that how much are they in

absolute figures and also the percentage or the margins right so i'll give you a

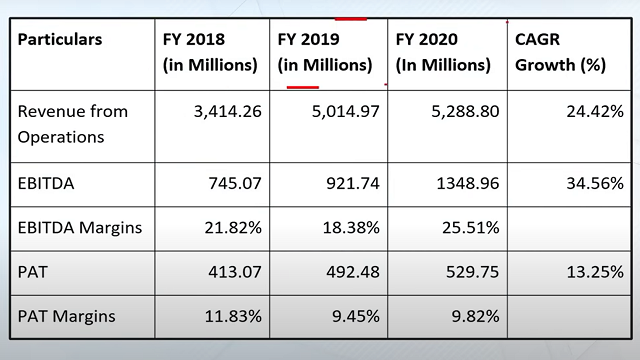

simple example how this typically is disclosed or shown in the prospectus here you

can see three years data will be given for sure so you can see financial year 18 ,19

and 20. what we add in our videos generally is that last column of cagr okay at

what growth rate have their revenues grown at

what growth rate have their profitability and ebitda ebitda grown right now what we

do one step ahead is that we try to see whether their growth rate is higher than

the industry growth rate so on an average is revenue growth for the industries let us

say 14 this company is growing by 24 higher than industry good point okay so that's

how we check the basic few pointers for p and n

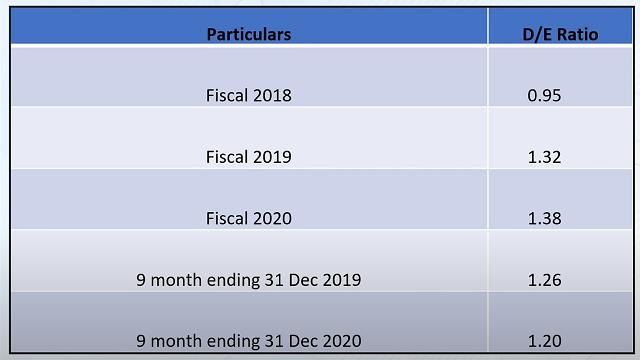

then we go out with the balance sheet analysis in balance sheet analysis again there

are a lot more points but just to give you one example very basic thing that you

have to check is the debt to equity ratio i'm sure everyone by now knows that

up to two is to one is okay what is the scenario for anupam let's quickly check

that for 18 ,19, 20 it's way below two is to 1 highest we can see here is in fiscal year

20 which is 1.38 but still it's way below 2.2 is to one so i'm fairly good with that

okay one more thing that we check is cash flow from operations that's very

important what is that in simple words how much cash is the business able to

generate from its core operations okay if that is positive that's considered to be

good if that is growing at a good rate what better can we ask for right corona period

they have done very well in their cash flow from operations so can i say that's a very

big positive answer is obviously yes

VALUATION

well next point that we check is what is the valuation of the company right

so how can we value a company generally one of the good parameters is p e ratio

price to earning ratio but you know in some cases for example the recent one

zomato ipo we could not check p e ratio why our company was in losses in

that case what do we do we can use the p to s ratio which is which is the price to

sales ratio right all these ratios like p e, p b then ev ebitda

few basic parameters that we have to check for the valuation so please understand if

the company has valued its share very at a very high price don't you think

that the listing gain chances are a little bit less right so whenever i do any ipo

review i say valuation is comparatively less so there is some error left for listin

gains there is some juice left for listing gains but evaluation is on a very high

end there are less chances of listing gates that's why valuation is important is there

any other

parameter through which i can gauge how much is the listing gain how much is

the possibility of listing gain for that we have something

known as

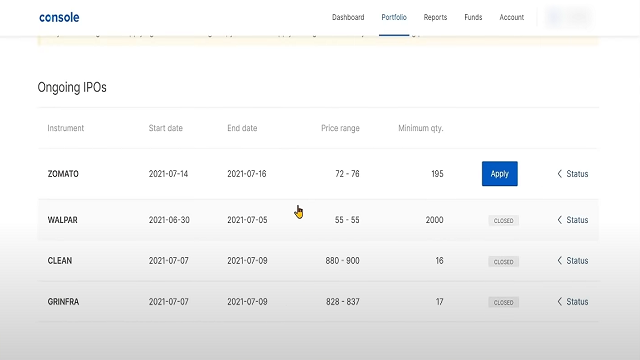

gmp which is a great market premium this is i'm just showing you one website on

this website you can get to know about how much is the expected gray

market premium it's the website name is ipo

" watch.in " through which you can check i'm just scrolling down this is where you

can get to see what is the gray market premium so i hope with all these parameters

you have understood some basics about valuation

GMP

well before we proceed i would like to give one or two additional points about gmp

as to how it really works okay so just as an example if the ipo price is say 500

rupees and let's say the gray market premium as per that ipo watch website is 150

okay so it is expected that the ipo should list on the stock market at 500 plus 150

that is at 650 rupees so i'll quickly tell you what were the facts and figures for

unborn sign ipo so the issue price was 555 and when the issue closed

for subscription on 16th march the gmp on that day was 150 so ideally it should

have gotten listed at 705 house 705 150 150 plus 555 so it should have gotten listed

at 705 but it got listed at 520 only so please understand is gmp the full and final

thing that this is going to happen no it's just a guidance it talking about all these

things what is the current scenario post four months of listing

today the ltp latest ldp is 815 which is currently at 46.86 percent profit in my

portfolio

Post a Comment