well the next one through which you can understand when to enter and when to exit

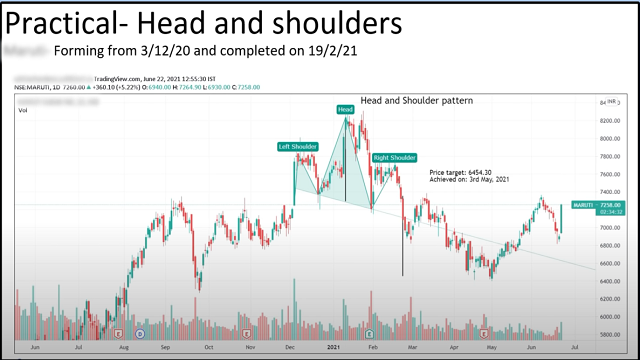

a stock is the head and shoulder pattern understood shoulder head shoulder

simple enter and stop loss so let's try and understand this practically this is a chart

of maruti now you can see below

this is nothing but the left shoulder then you can see a big head and followed by

a right shoulder now can you visualize this with my shoulders and the

head so you can see that left and right shoulders are almost similar in height

and head has a higher high okay now what happens is that you can now try and

draw a visual line joining these three points and this is called as a neck line

okay now once the neckline is broken on a downward side ideally this starts the

bearish trend of the stock

can i enter at this point when the neckline is broken

answer is yes

this is where ideally you should enter the stock this is going to be a short side

so this can be done in futures not in Intraday so you can short the stock when

the neckline is broken what can be your target now if you want to calculate it

precisely it's calculated something like this you have to first try and calculate

the distance between the neckline and the top of the head and whatever is this

distance place it from this point to this point okay so same distance is going to

be achieved the same target is going to be achieved below the neckline and if you

can see here this target was also achieved very recently on third may 2021 this is

how a head and shoulder pattern looks like now if you see here what happened the

stock started going down but then it reversed from here now should i have booked

my loss here what could be a stop loss it is generally at the shoulder point so in our

example here somewhere here around seven thousand seven hundred you can say

this could have been your stop loss i hope you have understood this

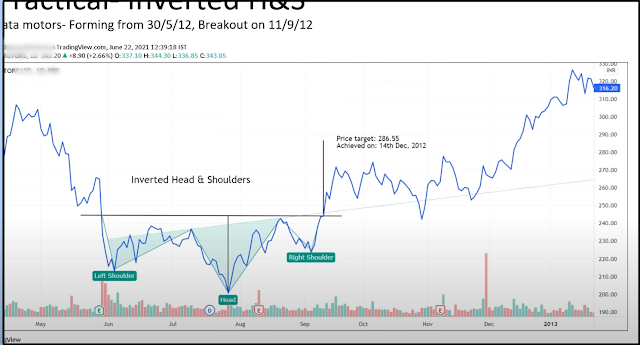

- REVERSE HEAD & SHOULDER PATTERN

now moving ahead to the inverted head and shoulder pattern now what will

happen shoulder head shoulder analyse neck line again these three points can be

joined shown in below chart

and this is where the neckline can be drawn this is which type of fat pattern this is

where your bullishness is going to be seen no what when should i enter is the first

one the moment this neckline is broken ideally here this is where you should

enter price target you should be calculating it in this way this is the

distance between the neckline and the head this distance you should add it up

here and this is where the price target is and in chart you can see this target

was achieved on 14th december it's an old one 2012 it's the chart of tata

motors now your stop loss could have been this point of your right shoulder i

hope you have understood when to enter when the neckline is broken when to exit

ideally at the target price achievement or if the stop loss is hit when is the

target price achieved that distance you have to count from neckline to the head and

stop loss is that point where your right shoulder point is made i hope both are

absolutely clear

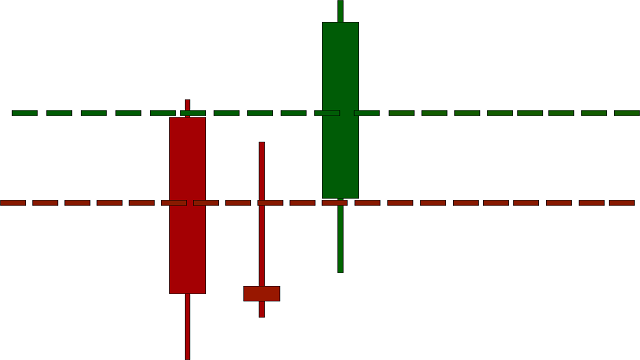

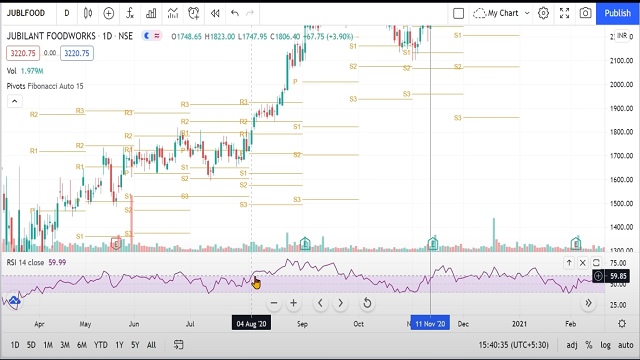

let's move on with the third indicator the pivot point indicator i'm going to tell you how to first apply that pivot point on the normal trading view chart so first i go to

fx function i search pivot point standard i click that once i click that now i go to the

setting wheels in type drop it down and select fibonacci and then click ok once this

is done your levels will be set up as per the fibonacci

what do we mean by pivot?

imagine a clock now in a clock what is the center point where all the hands of the

clock are actually linked with so that is nothing but the pivot point so if i come back

to the candlestick pattern this is the latest candlestick chart of maruti and suzuki

given below

i hope you have understood this how to draw the pivot it was simple effects go to

pivot point put it on the chart and then select fibonacci what do you see here p

p means what pivot r one is what resistance one r two resistance to r r3 resistance 3

similarly on the lower side you can see s1 s2 s3 will stand for support

1 support 2 support 3 question is when to enter as per this pivot point strategy it

is said that if you can see the pivot being strongly held okay or you can see a very

big bullish pattern on the pivot itself breaking the pivot from the bottom you may

enter that specific stock now we see here in maruti has it broken with good volumes

or something like that by the way this is the volume no not very amazing

volume scene but it has respected the pivot level okay so i should be keepin a watch on tha

if you see the next day next day you can see a big green candle and this is supported with good volumes you can see here

pivot keto it's well above the pivot point plus you can see that this r1 level resistance

one has also been taken out so in the first one and half hour itself the volume had

surpassed the previous entire day's volume so that shows how big strength is seen

in that stock so you can see that big green candle being formed that is where

during the day one could have taken a trade r1 broken but you can see that at r2 it

took a resistance and came down a little bit today on 23rd of june you can see that

the stock has also broken the r2 and now it is going towards r3 okay now if

someone would have already been

long a person may have taken partial profits here because ideally r2 generally acts

as a strong resistance but what happens here you can see that the volumes are also

very high even today so there's a great chance that it might

test r3 tomorrow but is this the only way just say the pivot take the position can you

do that answer is no you have to check out macd you have to check out rsi you have

to check out volumes and then based on the big combination of

all these things you have to decide whether to buy or whether to sell whether to

enter whether to exit all these things

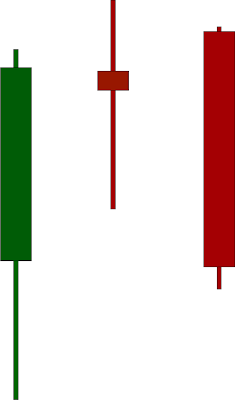

so let's move on with our next parameter which is rsi relative strength index now

what does this indicator tell us strength strength at which the stock can go in the

upward direction it shows the momentum of that stock so possibility number one

i'll say that the stock will go up

possibility number two i'll say that the stock will go up but with good strength with

good speed and if i want to know the second one strength speed that is indicated by rsi

- now how to put it in trading view?

you have to just click that fx and then hit rsi that is relative strength index so

generally what are the inbuilt parameters inbuilt parameters are 70 30 what i

always put up is the 60 40 parameter so i'm just taking it down to 60 40 and

then i press okay

i'm giving you an example of asian paints this is around december it has broken the

60 rsi you can see 60 rsi is broken on the upward side from below now once it

has broken this is ideally where one may enter a stock again same thing just because

rsi across the 60 are you going to enter answer is no this is one of the indicators

correct so rsi broken 60 from below that's where

ideally one can consider entering and now see this i'm just putting this as a vertical

bar okay just for those who want to learn about this all to v is the shortcut for this

automatically a vertical bar is drawn so this is where the 60 level was crossed it's going up

the rsi at this candle rsi at this candle is 80.87 so it is said that above 60 the stock

starts showing strength but once it reaches 80 now it is tired now see it has gone up

so much it will be tired now at some point of time it has to go down right

number one is once it crosses 60 it is ideally a green signal to buy once it

is at 80 it's a warning signal stock is tired you may exit your position

and one last time is this the only indicator answer is no i hope you have understood

very well how to use rsi to decide when to enter and when to exit

- INTERPRET PIVOT POINTS + RSI + VOLUME

well let's move on with last strategy i'm going to tell you this combined strategy

wherein i want to check three parameters

number one pivot

number two rsi and

number three volume

how can i use these three in combination to decide when to buy when to sell okay for buying let me tell you ideally what would i check number one rsi should have cross 60 number two volume should be highest in the last five trading sessions

and number three is that i would check whether that candle has very clearly given a breakout above pivot point and it is somewhere between that pivot

to r1 so let's see if i can see the all these three conditions being met in anyone stocks

jubilant food works we are somewhere around this is kind of an old data this is

4th of august 2020 now which is this point this is the point when 60 has been hit so

again i'm just drawing alt v here for vertical line this is where the 60 point has been

crossed you can see in picture chart now if you see here just one day before

pivot has been honored and the stock tried to go up but did not close at r1 it came

down again so it was not above it was not able to go it was not able to close

above r1

what happened on the next day next day the this stock itself has opened up as a gap

up and it has shown a very nice positive journey throughout the day and it has

almost closed at the highest point almost right now let's see what has happened

with the volume candle now you can see that this is the volume candle in picture

and it is way above all these previous candles generally has checked only last five

candles this is like last what 15 20 candles whatever i can see on the screen one may

say out of those this candle is the highest so three all three criteria number one

criteria is rs i went above 60 number two it is going strong it has already gone above p1 and it is

already testing r1 and number three volumes are very high now ideally if you

remember i told you r2 can be a question point so immediate next day was a

caution point for me but now i'm going to combine it with volumes are also

going very strong on day two also you can see that rsi is still above 60. you

remember i said that the stock will go up and up and up and up but it will be tired

at some point in time what is that some point in time when rsi is about to touch

80. so if you see here at this very point it has touched 80 okay i'm drawing a

horizontal line this is the eight take a line and which one is this day again put a

vertical line this vertical line you can see this was the highest point again seven

percent move in a single day ideally this is where we should stop because from

here if you can see again the stock is slowly and steadily the rsi is going below the

80 level and eventually it has gone even below 60 level does this mean that the

stock compulsory must show downward journey no can you miss out on the

probable profit answer is yes shall i show you what happened

the downward journey did not start and this is what was the highest point after

which a downfall started so please understand with technical analysis are you going

to get all trades correct no but is your probability of winning going to increase

answer is yes i hope you have understood how the combination of rsi volume

and pivot can be used together to gain more confidence while entering or exiting a

specific position

CONCLUSION

Using these strategy you can invest more and more and get a profitable return

i recommend you to use INTERPRET PIVOT POINTS + RSI + VOLUME strategy all you

need to focus on all strategy at a time if you have any query just comment down or you can

contact us

Post a Comment