Avoid

ing the Top 5 ETF MistakesINTRODUCTION-:

Did you know that the Canadian stock market only makes up 3% of the

global stock market cap? But Canadian investors still hold 59% of their equity

investments in Canadian stocks. It’s not just Canada, but it happens in every

country. This phenomenon is called home country bias. If you wanna know why

this is dangerous and if you wanna know 4 more ETF risks to avoid, then read this

article properly - so let’s go!

Mistake number 1

In ETF investing is home country bias. Home country bias means

" that investors favor stocks from their own country over those from

other countries. And it’s totally normal because you are more familiar

with the companies in your country."

But it is risky to only invest in your home country.In the last hundreds of years,

there were many cases where investors that were only invested in 1 country saw big

losses because of local stock market crashes, economic collapses or various other

reasons whilst the global stock market remained stable.

Examples-:

"

the Japanese stock market crash in 1990, the 1997 Asian financial crises,

the European debt crises in 2010 and the Chinese stock market crash in 2015.

Things can go down in 1 country. And 1 country alone can’t consistently outperform

all the others. Usually, periods of outperformance lead to overvaluations and

ultimately a regression towards the mean. Being globally diversified is the key to

portfolio

"

construction:

It has very little downsides but a lot of benefits like minimising

your drawdowns. The most well-known strategy to do this is the 70-30 portfolio in

which 70% of your money is invested in developed countries and 30% in

emerging markets. That also roughly represents the global GDP distribution.

Another much simpler and cheaper way to invest in the entire world is to pick a

Global ETF like the Vanguard Total World Stock Index Fund ETF.

This 1 ETF gives you access to 47 countries in both developed and emerging

markets.

Mistake number 2

In ETF investing is chasing the hot new trend. There are hundreds of new ETFs that come out each year - and many of them are chasing the newest trends. AI,

eGaming, 3D printing - Buying into the latest trends might get you high

returns - but be careful.

" All these hot new trends have one thing in common: They all start

outperforming the market for a few years, they become popular, the average

investor gets into a hot new trend at the peak performance and then they start

underperforming the market.The average investor gets frustrated with the

performance and starts selling to jump onto the next new hot trends. Buying high,

selling low: The worst thing you can do in investing. And that’s because investors love to chase past performance. They look at the last few years and project it into

the future and expect the same thing to happen again.But it doesn't work like that.

So before you invest in a hot new trend, make sure you do your homework and that

you understand the industry and future potential.

Mistake number 3

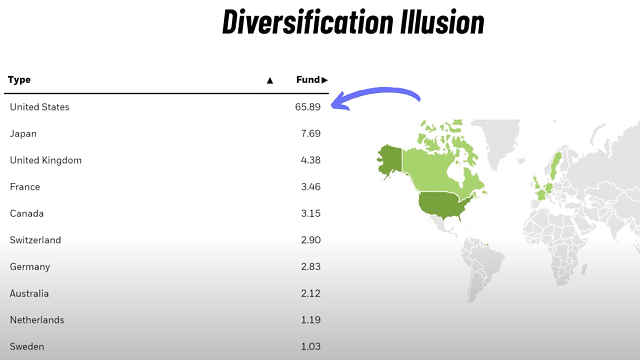

In ETF investing is diversification illusion.

Let’s look at an example "Let’s say that you are from the US. You start investing 500 dollars every month

through a savings plan into a US-focused ETF. And you picked

Blackrock's iShares Core S&P 500 ETF. Now you got a salary increase

and you want to use the extra 500 dollars to increase the diversification of your

portfolio.So you look online and find the iShares Core MSCI World ETF.

This ETF invests in 23 developed countries and covers 85% of the listed

equities in each country.You now invest 500 dollars into both the S&P 500

and the World ETF. Sounds pretty diversified, right? 50% is invested in the US

and the other 50% globally. But if you have a look at the factsheet of the iShares

Core MSCI World ETF, you will see that it holds over 66% of its assets in the US.

Your goal was to have a diversified portfolio, but you ended up allocating over 83% of

your investments into the US. And that’s the meaning of diversification illusion. "

That happens because most ETF are weighted by market cap. You can think of it

like a pie chart.With a market-cap weighted ETF, that pie chart is broken up into

slices based on the value of a company. If a company has a higher value, then its slice

will be bigger. And at the moment, the most valuable companies come from the US.

That’s why their share in global ETFs is larger.The opposite of this would be an

equal-weighted ETF where all the slices are the same size, no matter how big and

valuable a company is.

So be aware that most ETFs are heavily invested in the same companies and

countries. The more overlapping investments you have, the less diversification you

will have. If you’re from the US and you want to get global diversification

without overlaps, you can go for an international ETF that excludes the

US, like the iShares Core MSCI Total International Stock ETF, ticker

symbol IXUS.This ETF invests in 49 countries - excluding the US and gets you

diversification without overlaps.

Mistake number 4

In ETF investing is to move towards active investing.And that can happen in 2 ways.

- The first way is to actively trading ETFs. So by default, an ETF is meant to

be a passive product that just tracks an index. A fund provider like Blackrock sets up

a fund with an objective to track an index like the S&P 500. So they go out and

buy all the stocks of the S&P 500 in a way that it replicates the index.

So if the S&P 500 goes down 2%, then the ETF that tracks it will do exactly the

same. So - pretty passive.

But because you can buy and sell ETFs so easily, it is quite tempting

to use it for active trading. What you essentially do here is market timing.

And you can get market timing right. But there is a way higher chance that you get it

completely wrong and miss out on some really good trading days.

_______________________READ ALSO ________________________

________________________________________________________

In the last 20 years, if you would have stayed fully invested without

trying to time the market, you would have gotten an annual return of 7.5%.

If you would have done market timing and missed out on the 10 best trading days in

those 20 years, your return would have gone down to 3%! If you would have missed

the 20 best trading days, your annual return would have been below 1%.

- A more effective strategy is dollar-cost averaging. That’s when you invest the

same, fixed amount of money on a regular basis, like once a month. And with these

regular payments, you invest into the same ETF or stock. If we look at the S&P

500, for example, " you would have invested here, with your fixed amount,

you buy a different amount of shares each time.If you wanna know how dollar-cost

averaging performed in a 30 year downmarket or against perfectly timing the market

for 30 years,

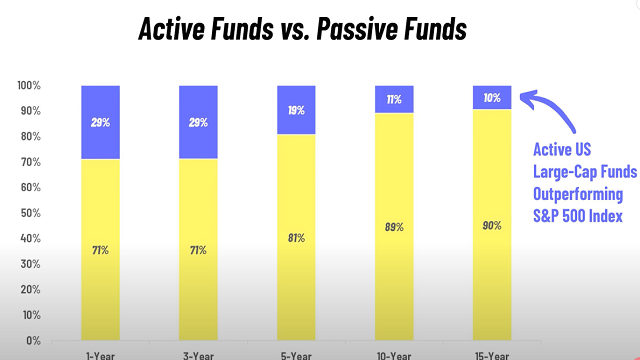

- The second way you can move towards active investing is to invest in actively

managed ETFs. And the name “ETF” is a bit misleading here, because they don’t

passively track an index, but actively pick companies - similar to an actively

managed mutual fund.The label “ETF” is often just used by those active funds to

participate in the massive ETF boom of the last years.

One example of those active ETFs is the ARK Innovation ETF which invests in

disruptive innovation. Actively picking companies can work for some fund

managers, but for the majority it absolutely doesn’t! Only 10% of actively

managed funds could beat the S&P 500 as a benchmark over a time

frame of 15 years.

Mistake number 5

In ETF investing is to be too obsessed with costs. There is so much competition now

which means that ETFs are becoming cheaper and cheaper. And that’s amazing for

us as investors.When you compare ETFs with actively managed funds, then you can

say that they are more like “raw” products. They simply track an index or a selection of companies in an automated way. There are no expensive fund managers

that research and pick stocks. And that makes ETFs much cheaper than actively

managed funds. ETF costs are displayed as total expense ratio which is sometimes

also called ongoing charges fee. It shows you the operating costs that an ETF

provider has for setting up and running a fund. These can include management,

trading, legal and auditor fees.Don’t get me wrong: It’s good to compare prices.

But if you go for any of the common and big ETFs from Blackrock or Vanguard, you

can hardly do anything wrong from a cost perspective. Blackrocks ETFs have an

expense ratio of 0.19% on average and Vanguard's ETFs cost 0.06% on average.

A total expense ratio of 0.06% means that you’re paying an annual fee of 60 cents

on a 1,000 dollar investment. That is low - that is very low.Don’t get too obsessed

with ETF costs and don’t feel like you constantly need to move around ETFs because

one provider is a tiny bit cheaper than the other.Doing that will result in

transaction costs and capital gain taxes only to save a few dollars per year. Getting

started and following your long-term strategy will get you higher returns over the

long run. So there you have it: 5 of the most common ETF mistakes and how to

avoid them. But what do you actually think?

Let’s look at an example

"

Let’s say that you are from the US. You start investing 500 dollars every month

through a savings plan into a US-focused ETF. And you picked

Blackrock's iShares Core S&P 500 ETF. Now you got a salary increase

and you want to use the extra 500 dollars to increase the diversification of your

portfolio.So you look online and find the iShares Core MSCI World ETF.

This ETF invests in 23 developed countries and covers 85% of the listed

equities in each country.You now invest 500 dollars into both the S&P 500

and the World ETF. Sounds pretty diversified, right? 50% is invested in the US

and the other 50% globally. But if you have a look at the factsheet of the iShares

Core MSCI World ETF, you will see that it holds over 66% of its assets in the US.

Your goal was to have a diversified portfolio, but you ended up allocating over 83% of

your investments into the US. And that’s the meaning of diversification illusion.

"

That happens because most ETF are weighted by market cap. You can think of it

like a pie chart.With a market-cap weighted ETF, that pie chart is broken up into

slices based on the value of a company. If a company has a higher value, then its slice

will be bigger. And at the moment, the most valuable companies come from the US.

That’s why their share in global ETFs is larger.The opposite of this would be an

equal-weighted ETF where all the slices are the same size, no matter how big and

valuable a company is.

So be aware that most ETFs are heavily invested in the same companies and

countries. The more overlapping investments you have, the less diversification you

will have. If you’re from the US and you want to get global diversification

without overlaps, you can go for an international ETF that excludes the

US, like the iShares Core MSCI Total International Stock ETF, ticker

symbol IXUS.This ETF invests in 49 countries - excluding the US and gets you

diversification without overlaps.

Mistake number 4

In ETF investing is to move towards active investing.And that can happen in 2 ways.

- The first way is to actively trading ETFs. So by default, an ETF is meant to

a fund with an objective to track an index like the S&P 500. So they go out and

buy all the stocks of the S&P 500 in a way that it replicates the index.

So if the S&P 500 goes down 2%, then the ETF that tracks it will do exactly the

same. So - pretty passive.

But because you can buy and sell ETFs so easily, it is quite tempting

to use it for active trading. What you essentially do here is market timing.

And you can get market timing right. But there is a way higher chance that you get it

completely wrong and miss out on some really good trading days.

_______________________READ ALSO ________________________

________________________________________________________

In the last 20 years, if you would have stayed fully invested without

trying to time the market, you would have gotten an annual return of 7.5%.

If you would have done market timing and missed out on the 10 best trading days in

those 20 years, your return would have gone down to 3%! If you would have missed

the 20 best trading days, your annual return would have been below 1%.

- A more effective strategy is dollar-cost averaging. That’s when you invest the

regular payments, you invest into the same ETF or stock. If we look at the S&P

500, for example,

"

you would have invested here, with your fixed amount,

you buy a different amount of shares each time.If you wanna know how dollar-cost

averaging performed in a 30 year downmarket or against perfectly timing the market

for 30 years,

- The second way you can move towards active investing is to invest in actively

passively track an index, but actively pick companies - similar to an actively

managed mutual fund.The label “ETF” is often just used by those active funds to

participate in the massive ETF boom of the last years.

One example of those active ETFs is the ARK Innovation ETF which invests in

disruptive innovation. Actively picking companies can work for some fund

managers, but for the majority it absolutely doesn’t! Only 10% of actively

managed funds could beat the S&P 500 as a benchmark over a time

frame of 15 years.

Mistake number 5

In ETF investing is to be too obsessed with costs. There is so much competition now

which means that ETFs are becoming cheaper and cheaper. And that’s amazing for

us as investors.When you compare ETFs with actively managed funds, then you can

say that they are more like “raw” products. They simply track an index or a selection

of companies in an automated way. There are no expensive fund managers

that research and pick stocks. And that makes ETFs much cheaper than actively

managed funds. ETF costs are displayed as total expense ratio which is sometimes

also called ongoing charges fee. It shows you the operating costs that an ETF

provider has for setting up and running a fund. These can include management,

trading, legal and auditor fees.Don’t get me wrong: It’s good to compare prices.

But if you go for any of the common and big ETFs from Blackrock or Vanguard, you

can hardly do anything wrong from a cost perspective. Blackrocks ETFs have an

expense ratio of 0.19% on average and Vanguard's ETFs cost 0.06% on average.

A total expense ratio of 0.06% means that you’re paying an annual fee of 60 cents

on a 1,000 dollar investment. That is low - that is very low.Don’t get too obsessed

with ETF costs and don’t feel like you constantly need to move around ETFs because

one provider is a tiny bit cheaper than the other.Doing that will result in

transaction costs and capital gain taxes only to save a few dollars per year. Getting

started and following your long-term strategy will get you higher returns over the

long run. So there you have it: 5 of the most common ETF mistakes and how to

avoid them. But what do you actually think?

CONCLUSION -:

You can read any information related to finance on our website, from the basics

of stock marketing, you can learn everything here, by bookmarking our website on

your page, for today we will meet in the next article.

Post a Comment