2021 Tax Brackets changes ( USA )

Introduction-:

In this article we gonna discuss about 2021 Tax Brackets changes ( USA ) what changes To know what changes we will get to see in tax,

so, basically the changes in 2021 in tax is based on these listed topics -:

- Tax Brackets & Rates

- Standard Deduction & Personal Exemption

- Alternative Minimum Tax

- Earned Income Tax Credit

- Child Tax Credit

- Capital Gains Tax Rates

- Qualified Business Income Deduction

Annual Exclusion for Gift

now without wasting more time let's discuss briefly every point you should know if you are a USA citizen

comparing 2020 taxes to 2021 taxes so you can understand the tax brackets see an example

and figure out whether or not you're gonna pay more or less in taxes in 2021

so i'm going to first go through the tax brackets

and then we're going to talk about the standard deduction and then we're going

to get into an example and go through the math for tax brackets for 2020

and then we're going to show an example for 2021 comparing the two so you can figure out whether or not you're gonna pay more or less

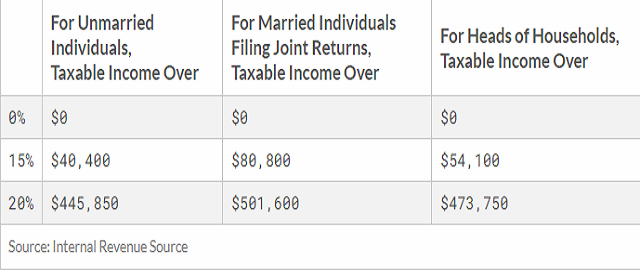

- Capital Gains Tax Rates

Tax Brackets & Rates

basically they work the same way they're just been slight adjustments from 2020 to 2021

and we can see here that we have the single individuals married filing jointly and also head

of household

- i don't have the married filing separately tax brackets but for all intents and purposes we can

figure out exactly how to do the math

just from these brackets so if we're looking at the ten percent we can see for singles it's from

zero to nine thousand eight hundred and seventy five dollars you would pay 10 of these

dollars

now the money that's over 9875 would go into the next tax bracket which would be 12

and you can see going from 2020 numbers to 2021 that there is a slight increase in each of

the brackets so for

example-:

over here we can see that 10 goes up to 9875 for someone that's filing single in 2020 but for

2021 that's gonna increase to nine thousand nine hundred and fifty dollars and you'll

generally see that change throughout all of the tax brackets

now what's really important to understand if

in an example:-

you're earning a hundred thousand dollars you're not going to want to just go to a

hundred thousand dollars for somebody that's single and say that

you're in the 24 tax bracket and that's because you need to also look at the standard

deductions

Standard Deduction & Personal Exemption

because i have the standard deductions right here and what the standard deduction

is and it's going to change depending on your filing status for someone that's single it's

twelve thousand four hundred dollars

and that's in 2020. and what this means is that the first twelve thousand four hundred dollars

is at zero percent taxes then you're not gonna pay any taxes on those dollars now whether

or not you take it from the bottom or the top it's still twelve thousand four hundred dollars

so in the same example if we're looking at

the tax brackets for say 2020 bring them back into view so you can see them again

and we can see that for singles it's up to 9875 dollars and we determined that

the 24 was right where a hundred thousand falls

but what we need to do is subtract

the twelve thousand four hundred dollars from a hundred thousand that's where you're going to get your tax brackets now in that

example

a hundred thousand isn't going to bring you below the eighty five thousand five hundred and

twenty six dollars but let's say that you earned ninety thousand dollars so ninety thousand is

still in the twenty four percent tax bracket

but because of the standard deduction it's going to decrease it

and then you're going to be in the 22

tax bracket and you're going to get that from the

example that we're going to go through next so in this example i want to hit on a

couple of points

so the example is going to be for a hundred thousand dollars for married filing jointly so it's

a hundred thousand dollars for the household and it's married filing jointly and i'm

also going to show you the effect of having a tax credit

Child Tax Credit

so we're going to include two kids so in this example it's going to be a hundred thousand dollars married filing jointly with two kids so if we calculate it

it's going to be a hundred thousand dollars

and it's going to be for married filing jointly with two kids

we're gonna go through this and it's gonna be for a hundred thousand dollars so the first thing that we need to do is take our hundred thousand dollars and we're gonna subtract our standard

Deduction

for married filing jointly that's twenty four thousand eight hundred dollars so we're going to

subtract our 24800 and for all the math just to make it as easy as possible to follow along

i'm gonna go through the math

so a hundred thousand dollars and we're going to subtract our 24 dollars and that is going to

be seventy five thousand two hundred dollars so seventy five thousand two hundred dollars

is our taxable amount so somebody that is earning a hundred thousand dollars married

filing jointly

whether they have two kids three kids or zero kids

is gonna bring them down to twenty twenty four thousand eight hundred giving them a

taxable amount of only seventy five thousand two hundred dollars so that's where we need

to do the calculation of our taxable amount so going back to the tax brackets for

married filing jointly we can see right here that the 10 is up to nineteen thousand seven

hundred and fifty dollars so we can put nineteen thousand seven

hundred and fifty dollars which is nineteen thousand seven hundred and fifty dollars

multiplied by 10 or 0.1 and that is going to equal 1975 now from 0 to 1975 we're gonna pay

one thousand nine hundred and seventy five

dollars in taxes now to get to the remainder of seventy five thousand two hundred dollars

that's going to be an additional fifty five thousand four hundred and fifty

dollars and we're going to multiply that by 0.12 or 12 percent so let me just go through

that math so i can show you what i did was i took this 75200 and we subtracted our 19 750

and that's going to leave us with the 55450 dollars now we're going to multiply that by 0.12

or 12 percent and that's going to be 6654. so i'll write that over here 6654 now we can add

these two numbers up and that's going to give us a total of 8629 -8629

Total tax

so this is our total tax liability so far but remember we said we're going to do this example

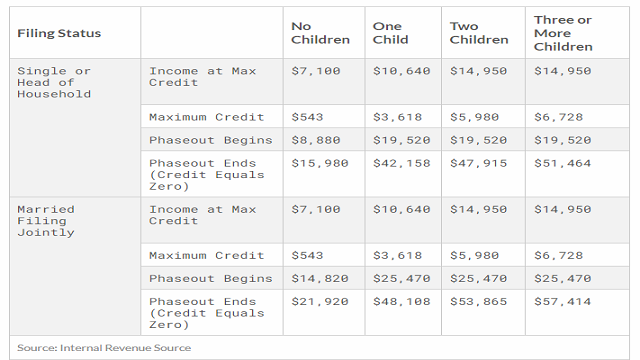

with two kids well that means that there's going to be a child tax credit and for 2020 and for

2021 it's the same amount it's two thousand dollars per child in this case it's two children so

that's going to be two thousand times two which gives us four thousand dollars

so what that means is we're gonna subtract four thousand dollars from our tax liability

leaving us with four thousand six hundred and twenty nine dollars in total taxes so that was

for 2020

so now let's flip over to the exact same

example

for 2021 with the bracket adjustments and the standard deduction adjustment so

let's go ahead and go through the math

so the example is going to be exactly the same just the brackets are going to be a little different and i'll put them up on the screen right here actually fold this over so we can see it a little bit easier and it's still going to be a hundred

thousand dollars but

in this example we're going to go through the standard deduction change and for 2021 for married filing jointly it's a little bit more it's 25100 so let's take our hundred thousand dollars and we're going to subtract our 25 100 dollars and if we do the math i'll do it again

on the calculator just so you can see it

100000 minus 25100 and that's gonna leave us with seventy four thousand nine

hundred dollars so our taxable amount in this example is seventy four thousand nine

hundred dollars the amount of the standard deduction is not taxable so let's go ahead and

flip over back to our tax brackets and continue to go through the math so i'll draw it out just

like i did before and in this case our 10 is going to go up to 19 900 for twenty twenty one so

that means that from zero to nineteen thousand nine hundred dollars we're going to multiply

nineteen thousand nine hundred dollars times point one zero or ten percent so if we do that

math it's going to be one thousand nine hundred and ninety so nineteen thousand nine

hundred dollars multiplied by point one and that is going to give us our one thousand nine

hundred and ninety one thousand nine hundred and ninety and see the same as we did

before we're going to take our seventy four thousand nine hundred dollars and subtract our

19900 so 74 900

minus 19 900 and that's going to be 55 000 so 55 000 and now that's going to be in the next

tax bracket are 12 percent tax bracket so we're going to multiply 55 000 times 0.12 and that

is going to be 6 600 so multiplied by thousand 0.12 hundred dollars and then we're going to

add these two numbers up so it is going to equal 8590 8590 and in the same example this

the child tax credit is exactly the same as it was in 2020 so it's gonna be four thousand

dollars we have two kids two thousand per child that means it's going to be four thousand

dollars so we're going to subtract our four thousand dollars from our tax liability for that

credit and that is going to equal 4590. so if we compare the two we could see that 2020 and

2021 going from 4629 at the same hundred thousand in the same example is going to

decrease to 4 500 and now even though in both scenarios we're in the 12

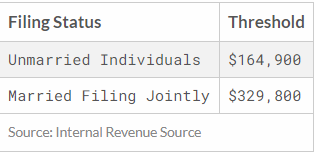

Qualified Business Income Deduction

Earned Income Tax Credit / Capital Gains Tax Rates

tax bracket that was our highest tax bracket that we were in our average or marginal tax rate

is significantly lower so the marginal tax rate is your average taxes paid on your entire income so in this example it's pretty easy to figure it out but i'm going to show you the

math so if you were wondering exactly what

your average tax was

this is how you can figure it out what you're going to do is you're going to take your tax

liability and then you're going to divide it by the amount of your total income which is a

hundred thousand dollars so in this case if we take six hundred and twenty nine

and we divide that by one hundred thousand we're going to get point zero four six

three or four point six three percent and that was rounded and the same for

2021 it's going to be 4.59 and again we just took the 4590 and divided it by a hundred

thousand so even though we were in the 12 tax bracket our average or also known as our

marginal tax rate is significantly lower in both scenarios

so understanding how your tax brackets work

goes beyond just knowing how they work and how much you're gonna pay in taxes it could

also help you make smarter

financial decisions

such as whether or not you should put more money into your traditional 401k or your roth

401k or whether or not you're going to qualify for a stimulus check

so there's a lot of benefits to understanding how your taxes work so make sure that you go through them to maximize the amount that you can put into your retirement plans

and reduce those taxes

--------------------------------------------CONCLUSION---------------------------------------------

According to the tax bill of 2020 of USA, we have not seen any special changes in 2021, just if you are a couple person then you may have to pay more tax, well they have different rules, I have also told you to calculate by yourself. By which you can calculate and pay your tax yourself

If you are a USA Citizen, then definitely read this article completely, it can be of great use to you.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>><<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

FAQ

Post a Comment