Mid Cap Mutual Funds: Invest in Best midcap Equity Funds 2021

PREFACE

_________________________________________________________________________

IINTRODUCTION

AXIS MID CAP FUND

MIRAE ASSET MID CAP FUND

PGIM INDIA MID CAP FUND

_____________________________________________________________________________

Introduction-:

Today we will talk about top 3 mid cap mutual fund but before that we will know

what is mid cap mutual fund Mid cap mutual funds are such funds which invest

their money in 101 to 250 companies but you have to keep one thing in mind that if

you are not a risk taker then I would advise to stay away from mid cap

#1 AXIS MID CAP FUND

Axis is at the top of the market, its asset under management budget is more than

14,000 crores, it can give you a lot of benefits.

And if we talk about its expense ratio, then it has an expense ratio of 0.5%, which is

the average expense ratio for any company, you will remember that in the previous

blog we told you what is the expense ratio, how does your expense ratio work? If

you are less then how much returns you will get, if you do not read, then the link is

given below, you can read by clicking

If we talk about its market cap wise allocation, then this fund invests the most

money in its mid cap company and some percent is also invested in large cap, you

can do the chart analysis as given below

MARKET CAP ALLOCATION

large cap 34.51%

mid cap 58.84%

small cap nil

If we look at its sector wise allocation, it has

SECTOR ALLOCATION

financial 18.07%

technology 12.99%

chemicals 11.19%

healthcare 8.62%

service 8.05%

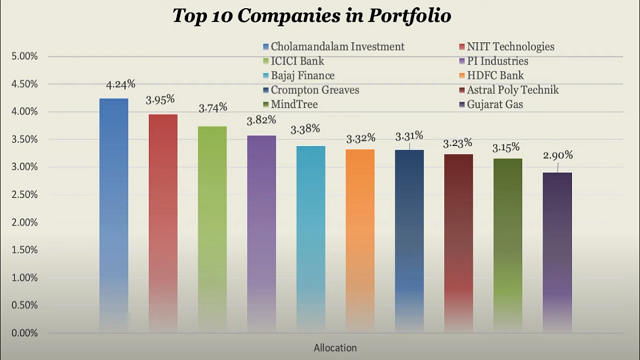

Top 10 companies with which it has tied up, you can see its portfolio below

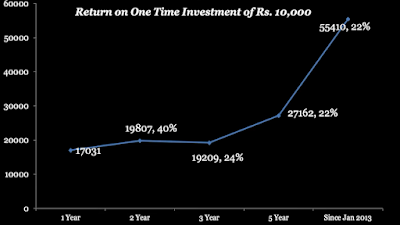

Now if we talk about its return rate, then it has given a return of about 70% in just

one year, how we will try to understand with the help of this chart below, if we had

invested 10,000 rupees 1 year ago then 1 year In this you would get its returns up to

17,000 comfortably

The rest you can chart in how much return you get.

#2 MIRAE ASSET MID CAP FUND

its asset under management budget is more than 6,000 crores, it can give you a lot of benefits. This is a fund which comes in mid cap category.

what is AUM asset under management ?

And if we talk about its expense ratio, then it has an expense ratio of 0.48%,

Which you can say, to see the expense ratio less than the previous one, I am telling

you here again that the lesser the expense ratio, the more benefit I have given

above, you can know about the expense ratio from that.

If we talk about its market cap wise allocation, then this fund invests the most

money in its mid cap company and some percent is also invested in large cap, you

can do the chart analysis as given below

MARKET CAP ALLOCATION

large cap 25.92%

mid cap 63.55%

small cap 10.12%

If we look at it according to the market cap, then this company is taking more risk

than the previous company, they have also invested their money in small cap fund.

It is simple, as you increase your allocation, your risk will increase as much as the

allocation means that you can take it as an investment of the company, if the

company has invested in all three market caps, large, mid, and small, then the risk

is more in it. is depend on you

If we look at its sector wise allocation, it has

SECTOR ALLOCATION

financial 22.73%

FMCG 7.83%

engineering 8.52%

healthcare 10.86%

automobile 7.88%

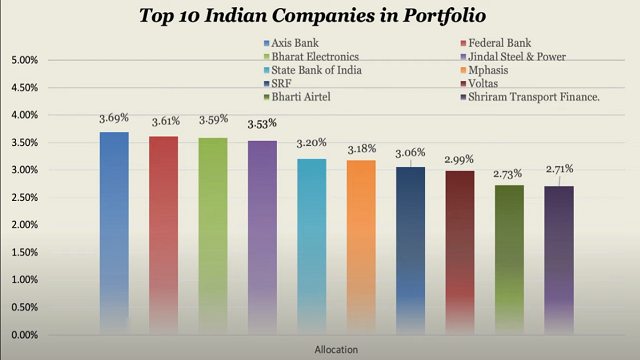

If we see in the chart below, it has invested the most money on Axis Bank, followed by 10 Indian companies on which they have invested.

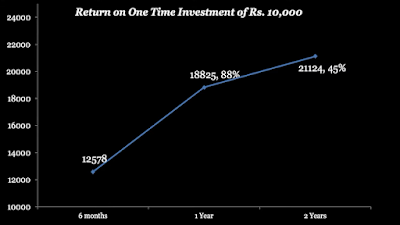

Now if we talk about its return rate, then it has given a return of about 88% in just

one year, how we will try to understand with the help of this chart below, if we had

invested 10,000 rupees 1 year ago then 1 year In this you would get its returns up to

18,000 comfortably

READ ALSO -:

_________________________________________________

______________________________________________________

#3 PGIM india mid cap opportunity fund

its asset under management budget is more than 2709 crores, it can give you a lot of benefits. This is a fund also which comes in mid cap category.

And if we talk about its expense ratio, then it has an expense ratio of 0.35%,

Which you can say, to see the expense ratio less than the previous one, I am telling

you here again that the lesser the expense ratio, the more benefit I have given

above a link , you can know about the expense ratio from that.

If we talk about its market cap wise allocation, then this fund invests the most

money in its mid cap company and some percent is also invested in large cap, you

can do the chart analysis as given below

MARKET CAP ALLOCATION

large cap 15.85%

mid cap 71.5%

small cap 9.21%

If we look at it according to the market cap, then this company is taking more risk

than the previous company, they have also invested their money in small cap fund.

If a company has more money in the large cap market, the company is most at risk,

as it puts its money on small and mid caps, the risk goes on increasing in the same way.

If we look at its sector wise allocation, it has

SECTOR ALLOCATION

financial 15.2%

technology 10.69%

engineering 11.93%

healthcare 14.71%

construction 9.25%

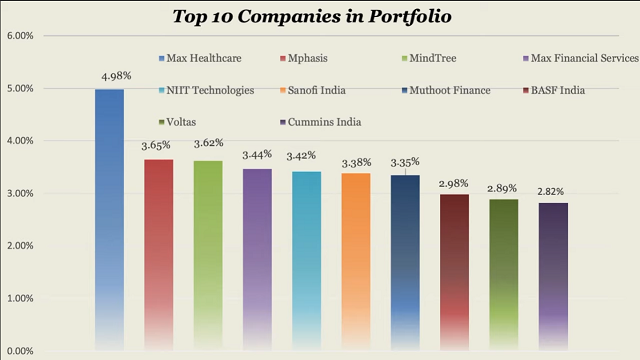

If we see in the chart below, it has invested the most money on MAX HEALTHCARE, followed by 10 Indian companies on which they have invested.

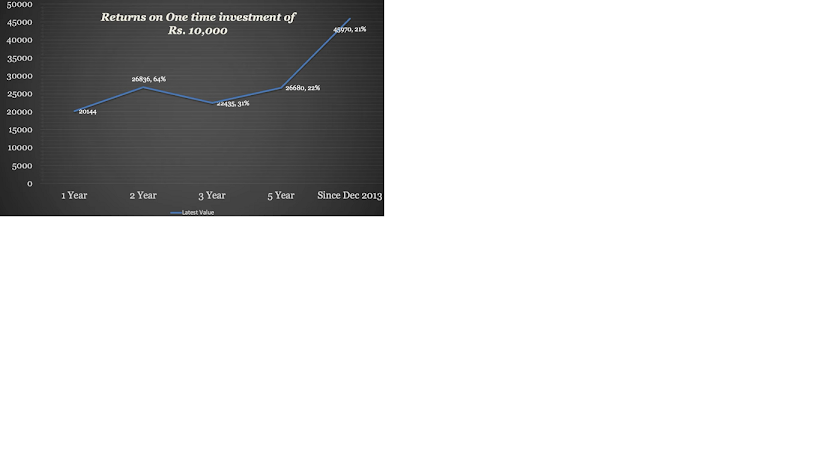

Now if we talk about its return rate, then it has given a return of about double in

just one year, how we will try to understand with the help of this chart below, if we

had invested 10,000 rupees 1 year ago then 1 year In this you would get its returns

up to 20,000 comfortably

Carefully, those who have taken more risk for their company i.e. they have invested

more in mid and small cap market, only then your earning also doubles.

We have listed all the companies listed above by ANALYSE, if due to any reason we

will work according to the prediction, then we will not be responsible for losing any

person because of this, we will not be responsible for such stock market finance

information. For this you can bookmark our website, that's all for today

Post a Comment