Best Large & Mid Cap Equity Mutual Funds

Introduction-:

Large and mid cap funds are such funds that invest their money in both large and

mid cap companies, that is, they invest in India's top 250 companies, if you want to

take less risk, then large and mid cap funds are available for you in the market. It is

available, you can invest on it, today I will talk about which large and mid cap funds

can benefit you.

- CANARA ROBECO emerging equities fund

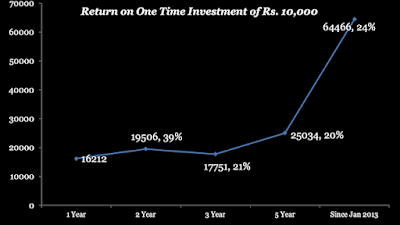

So friends, the first fund is Canara Robeco Fund, which comes under large and

mid cap funds, if we talk about its asset under management, then its AUM

is Rs 10,985 crore.

AUM (Asset Under Management) If you have not read about it, then check our

previous blog, the link is also given below, you can read it from there.

And if we talk about its expense ratio, then its expense ratio is 0.62%.

Again, check out my previous blog, you will get complete information about expense

ratio, yet let me tell you once.

Expense ratio - An expense ratio is determined by dividing a fund's operating

expenses by the average dollar value of its assets under management (AUM).

The same if we see its market cap and allocation, then they have invested more in large caps as you can see in the chart.

MARKET CAP ALLOCATION

large cap 56.73%

mid cap 38.43%

small cap 2.17%

Talking about its allocation sector wise, they have invested the most in financial companies, read the chart below.

SECTOR ALLOCATION

Financial 28.81%

Healthcare 10.62%

Services 8.26%

Technology 8.1%

Automobile 7.87%

Now if we talk about its return, then if you had invested 10,000 rupees in it 1 year ago, then after 1 year it would have increased to 16,000 i.e. you would have returned 62% in 1 year.

- MIRAE ASSET Emerging bluechip fund

the second fund is Mirae asset emerging bluechip Fund, which comes under large and

mid cap funds, if we talk about its asset under management, then its AUM

is Rs 20,615 crore.

again AUM (Asset Under Management) If you have not read about it, then check

our previous blog, the link is also given below, you can read it from there.

And if we talk about its expense ratio, then its expense ratio is 0.7%.

The same if we see its market cap and allocation, then they have invested more in large caps as you can see in the chart.

MARKET CAP ALLOCATION

large cap 57.25%

mid cap 38.39%

small cap 3.63%

Talking about its allocation sector wise, they have invested the most in financial companies, read the chart below.

SECTOR ALLOCATION

Financial 29.3%

Healthcare 10.72%

Services 9.65%

Technology 7.97%

Automobile 6.51%

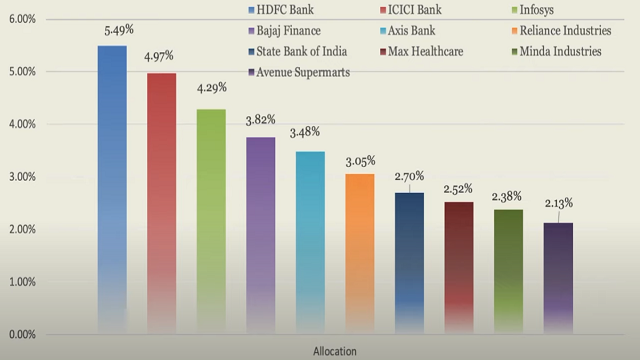

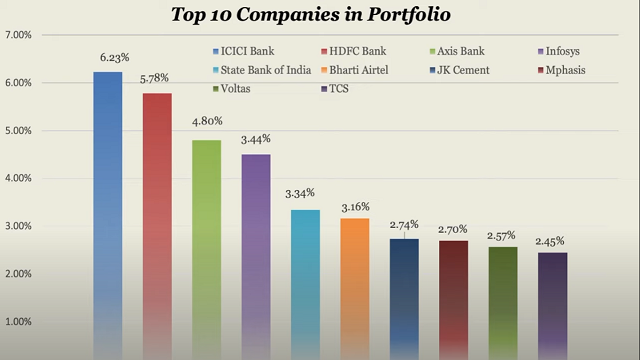

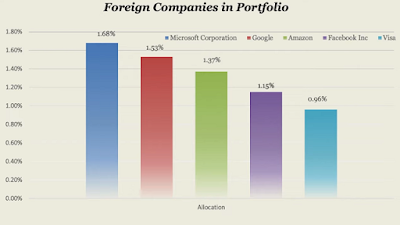

The same if we look at its top 10 company portfolio, in which it has invested the most money, then you can see the chart below.

Now if we talk about its return, then if you had invested 10,000 rupees

in it 1 year ago, then after 1 year it would have increased to 16,700 i.e.

you would have returned 67% in 1 year.

- AXIS GROWTH Opportunity fund

the second fund is Mirae asset emerging bluechip Fund, which comes under large and

mid cap funds, if we talk about its asset under management, then its AUM

is Rs 4322 crore.

And if we talk about its expense ratio, then its expense ratio is 0.51%.

The same if we see its market cap and allocation, then they have invested more in Mid caps as you can see in the chart.

MARKET CAP ALLOCATION

large cap 45.63%

mid cap 50.2%

small cap 3.02%

Talking about its allocation sector wise, they have invested the most in financial companies, read the chart below.

SECTOR ALLOCATION

Financial 20.12%

Chemicals 18.91%

Services 10.38%

Technology 23.93%

FMCG 5.66%

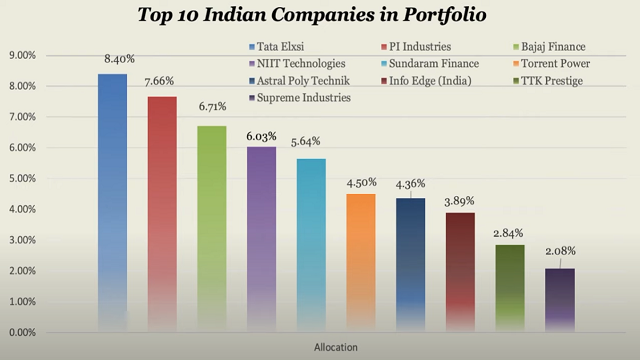

The same if we look at its top 10 company portfolio, in which it has invested the most money, then you can see the chart below.

Now if we talk about its return, then if you had invested 10,000 rupees

in it 2 year ago, then after 1 year it would have increased to 20,000 i.e.

Post a Comment